Have you ever played darts? How about blindfolded without knowing where the board is? That’s basically what launching a new startup without adequate market research is like — you’re just guessing and hoping for the best.

More experienced entrepreneurs know that the best business plans and product ideas are usually informed with cold, hard facts. Market data can tell you precisely what your potential customers want and need without any guessing at all. The hard part is knowing how to do market research for a startup.

In this guide, we discuss the best research and marketing strategies for a small business. We outline five types of market research goals and methods you can start using right now, but first let’s go over some of the basics, starting with the question “what is market research?”

What is market research?

Market research is the process of collecting information and data about your target markets and customers: what people want to buy, what products aren’t available yet (identifying market gaps), and what people are willing to spend on them. Because different customers and types of customers are all unique, a large portion of market research is devoted to understanding your brand’s particular target audience.

Why startups should conduct market research

So why do small businesses need to conduct market research? In short, to help guide their decision-making. The greatest advantage of market research is enabling you to make informed business decisions. Entrepreneurs with reliable market research don’t have to guess about what products people want or which marketing campaigns will work on their target customers.

Market research validates a new business idea or new product idea, eliminating risky business decisions. The right data can also test the viability of a new business plan, even an experimental one. At the very least, market research looks impressive to investors, who have their own risks in mind. With that in mind, let’s take a look at some different types of market research.

Types of market research

Marketers aren’t (normally) scientists, so let’s review some of the technical terms used in market research in case they’re unfamiliar to you.

First, let’s talk about primary research and secondary research. Primary market research is when you collect new and original data yourself, such as using online surveys or focus groups. Secondary market research is when you review pre-existing data from another company or data collection agency. Secondary research is just as useful as primary research — and sometimes cheaper — but it doesn’t give you the specific and unique answers you might need.

Second, you should also understand the difference between quantitative research and qualitative research. Quantitative research yields empirical data, i.e., verifiable data like numbers, figures, or factual observations. Qualitative research, on the other hand, yields abstract data like opinions, tastes, and emotional responses.

While quantitative data is written in stone, qualitative data is less substantial; nevertheless, qualitative research can still reveal insights into customer satisfaction and pain points, which helps tremendously with product development and new product ideas.

Before you start the market research process…

Before you dive into quantitative data collection, it’s best to prepare a bit so you don’t waste your efforts. Above all, you need to define your research goals. Consider asking yourself these questions:

- What does your company need to know?

- What research questions do you need answered?

It’s best to think about these things first because your goals determine your market research methodology.

It also helps to come up with some hypotheses before the actual data collection. Hypotheses are ideas of what you think will happen before testing; having a few hypotheses in mind can help steer the direction of your market research. Just don’t be afraid to abandon these ideas if the data proves them untrue.

Now, let’s take a look at five popular market research tactics to help you get started.

1. Identify your target audience

Choosing the right audience is crucial to any business. Your target customers have their own special wants, needs, preferences, and pet peeves, all of which are likely different from another company’s target customers. By narrowing down your target market, you can hand-tailor your business strategies specifically for them.

If you already have an established business, pay attention to the demographics of your top customers: age, geographic location, income, education, etc. Other information like shopping behavior and personal interests can also offer insights that can improve your business strategy.

Once you have a solid understanding of your target customers, try creating buyer personas. Buyer personas are fictional characters that represent the key attributes of your real-life customers — whenever you’re faced with a business decision, ask yourself, “What would our buyer personas want?”

2. Find your target audience’s pain points

One of the most important types of market research, especially qualitative research, is identifying your target market’s pain points. What do your target customers hate in their life that your product or service can fix?

For starters, knowing your audience’s pain points can improve customer satisfaction. Moreover, if you understand what your customer needs, you can create new product ideas or modify existing products to address those needs. You may even come up with a new business plan or startup idea.

Aside from talking to them directly (which we discuss below), take a look at similar products and how your target customer responds to them. Is there a market gap for customer needs that aren’t addressed in your target market? What do shoppers like and dislike about the current available products? These are the research questions that can fuel better and more successful product ideas.

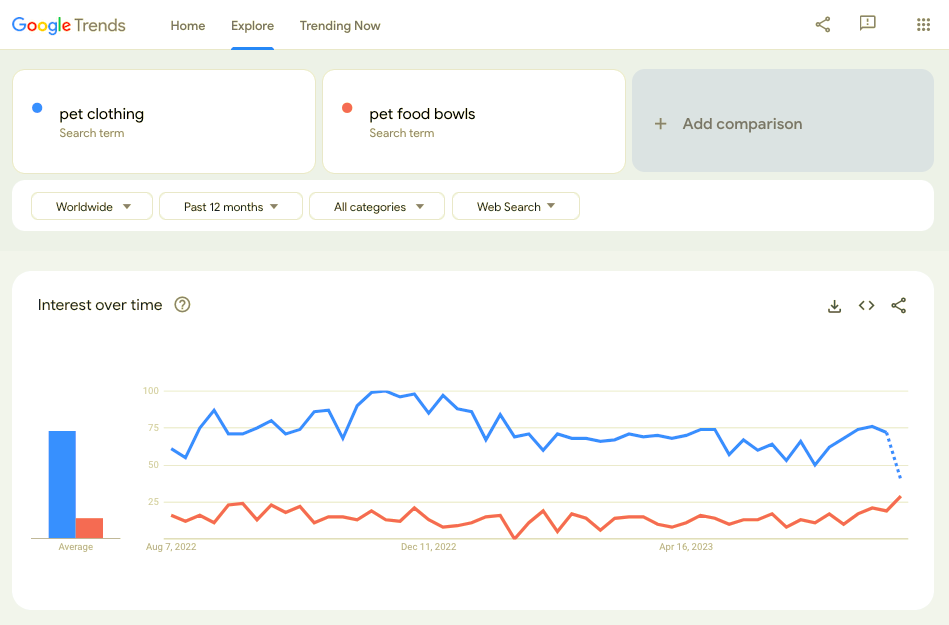

3. Analyze industry trends

Data collection for market research isn’t just about your target audience. It’s also about the industry in general. Following industry trends is excellent for secondary research — you can see what your potential customers are thinking just by looking at the state of the market.

For one thing, stay up-to-date on industry reports and public market analyses. Try to find a trustworthy source for news about your industry so you can discover market trends while they’re still new. Although less reliable, you can also glean what’s going on with your market by following relevant people and topics on social media.

Additionally, consider doing some competitor analysis. You may be able to discover some market trends just by watching what your competitors are doing. Also, competitive analysis can reveal holes in your competitors’ business plans that you can take advantage of, such as missing a key demographic that you can target instead.

4. Communicate with your audience

Of course, the best research method for reliable data is to go straight to the source: your target audience. You’ll find the most useful data comes directly from them.

One-on-one conversations like in-depth interviews yield the best results because you can tailor your questions as you go and pivot to new topics as needed. The downside is they might cost more and take up more time. Traditionally marketers relied on focus groups, however they have their problems. Focus groups tend to succumb to both peer pressure and host influencing, both of which can corrupt data.

A cheaper alternative is simply messaging your potential customers on social media, such as posting an open-ended question. This is not very efficient for data collection, however; there’s no guarantee the people answering are part of your target audience, or even telling the truth. Still, it can be useful to get a feel for your audience as long as you don’t take everything for fact.

Last, you can use online surveys and questionnaires, such as marketing emails or website pop-ups. These are not intensive for the participants and you can put them in places only your target audience would find.

5. A/B testing

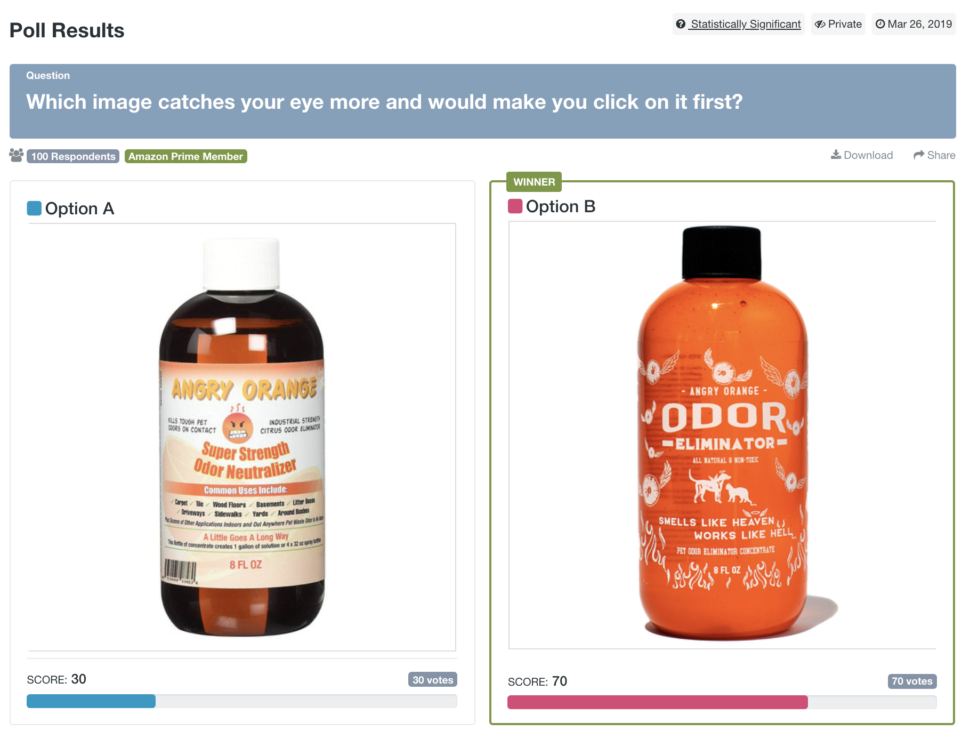

Sometimes asking questions isn’t enough. One of the most powerful research tools a marketer has is A/B testing: show a participant two or more options to see which they like best.

For example, if you have two different product designs and you want to see which your target customers prefer, you can pit them against each other in a Head-to-Head poll to see which is more popular. If you have a few different variants, you can use a Ranked poll in which participants rate all the options from most to least favorite, with a final score calculated at the end for each.

You can apply A/B testing to almost every aspect of your business. Typically, entrepreneurs use it to test variants of an image, such as a product photo, website landing page design, brand logo, etc. However, savvy marketers can also use it to test any number of things, from pricing to slogans to new product ideas.

If you’re using PickFu for marketing, you can also narrow down who can participate to hone in on your target audience exclusively. PickFu not only lets you filter demographics like age, income, education, etc., but also personality types and behavior, such as people who use Amazon Prime or people who go to the gym more than 3 times a week.

Moreover, PickFu encourages participants to write-in comments about why they made their choices. This gives you valuable insights into how your target audience thinks, stated in their own words.

With the participant commentary and calculated scores, A/B testing gives you both the quantitative and qualitative data you need to make smart, informed business decisions. Sign up for free now and see for yourself the difference PickFu makes.