Every business needs to stay on top of customer opinions. Customer feedback is a bridge between the boardroom and the consumer – it should guide all your efforts, from product development to marketing.

Customers’ opinions about your brand, products, services, and experience impact how likely they are to return, their potential for bringing in new business, and how well you’re performing against the competition.

So how do you effectively measure customer satisfaction and feedback?

One of the most common methods is the net promoter score (NPS) – but how well does NPS actually meet business needs? Let’s explore the pros and cons of NPS and some alternative options, starting with what good customer feedback should look like.

Three pillars of customer feedback

The primary goal of customer feedback is to improve customer retention. After all, it’s far more cost effective to keep customers than it is to earn new one.

With that goal in mind, a successful customer feedback strategy should be:

· Accurate: the results recorded should be reliable, unbiased, and repeatable.

· Quantifiable: you should have a score, number, or metric to track your performance over time.

· Actionable: the feedback you gather should offer context that you can use to improve your performance going forward.

What is a Net Promoter Score (NPS)?

An NPS is a simplified snapshot of customer satisfaction and loyalty. It asks respondents to answer this question on a scale of 1-10: “Would you recommend this business/product to a friend or colleague?”

The customer chooses a number from 1-10 as their answer, with 1 being the least likely to recommend the product and 10 being the most likely.

Let’s break down how NPS works in more detail.

Anyone who answers your NPS question with a 1-6 is considered a detractor. These are people who may hurt your ability to earn new customers because they dislike your product.

Anyone who answers 7 or 8 are considered passives, and their responses are not included in the final score.

Those who answer 9 or 10 are considered your promoters – the people who are most likely to promote your business to others.

The NPS score ignores your neutral respondents. To get your score, just subtract the percentage of detractors from the percentage of promoters.

Let’s say you survey 500 customers, and 200 are neutral, 75 are detractors (15%), and 225 are promoters (45%). Your NPS would be 30 (45 minus 15).

What is an ideal score to aim for? The creators of NPS (Bain & Company) say that anything above zero is a good score, while 50 or higher is excellent.

Pros of NPS

NPS is a simple, easy to understand, and quantifiable metric for measuring customer satisfaction. It tells you at a glance if you’re on the right track.

You can also ask for NPS ratings on different aspects of your business. If you’ve ever done a shopper survey, you might have been asked to rate your willingness to recommend the overall business, a particular product you bought, or something else entirely.

Because an NPS is a quantitative metric, you can track your scores over time and spot trends in the rating. If it’s improving, that’s a great sign for your business. If it’s declining – especially after a recent change – you’re probably headed in the wrong direction.

Cons of NPS

The NPS provides a simple answer to a bigger, more complex market research problem. The result is that you often miss out on the nuances and context behind the scores. That makes it hard to truly measure the “why” behind your NPS results.

These types of surveys can return inaccurate results too. For example, respondents might give a score of 10 just to move on to the next question or dismiss the survey.

Some cultures are also more prone to be harsh judges. If your customer base believes that 8 out of 10 is the best score they can realistically give a product, this could lead to lower NPS scores than you might get with different audience segments.

One way to mitigate these cons is by adding a free-text field that asks customers to elaborate on their responses, but this adds more complexity and a bigger workload when analyzing results.

You could also opt for a different method to gauge customer satisfaction levels. Some can work in complement with an NPS, while others replace it entirely.

Alternatives to NPS

One alternative to NPS is to use a similar metric or score. The most common of these include the Customer Effort Score (CES) and Customer Satisfaction Score (CSAT). Other NPS alternatives include using consumer research surveys to get a richer sense of customer needs.

Let’s start by looking at metrics that are similar to NPS.

Customer Effort Score (CES)

The CES is useful because it helps you understand how frictionless your app or product is. The concept was made mainstream by a Harvard Business Review article on the importance of having a good user experience.

The better your user experience, the less chance of a customer churning.

Your CES question might ask “How easy was it to use this feature?” This will help you understand the pain points of your product, app, or service.

The CES can be used at different stages of the customer journey and in a variety of businesses, from apps to airport facilities. It can use a numerical scoring system like NPS, or even replace numbers with emoticons.

Most of the time, a CES will have a score range of 1-7. It’s calculated by taking the number of people who answered 5, 6, or 7 and dividing it by the total number of respondents, then multiplying the result by 100 to get a percentage.

For example, if 100 people responded and 65 gave you a rating of at least 5, your CES would be 65.

Pros and cons of CES

The CES shares some attributes with the NPS. It offers businesses a quantifiable, trackable, and easy-to-understand snapshot of customer satisfaction.

CES rates are most accurate when the survey is presented to the customer during their interaction with your product or company, but that can also be intrusive and cause them to rate you lower than they otherwise would.

Like NPS, a CES score on its own lacks insight and context, so it can be hard to make the right change to improve this score. This issue is mitigated slightly by audience research tools that let you add follow-up questions to get more insight from consumers. But a CES remains just one glimpse into your overall performance with customers.

Customer Satisfaction Score (CSAT)

Many companies try to measure customer satisfaction through a CSAT survey, which is similar to an NPS or CES in look and feel. It asks the broad question, “How satisfied are you with this [product, service, or feature]” and sometimes asks a follow-up question (“Why?”) to glean more actionable insights. Typically, you’ll measure CSAT on a scale of 1-5 (from “very unsatisfied” to “very satisfied”).

Calculate your CSAT by taking your most positive respondents (scores of 4 or 5) and dividing them by the total number of respondents to reach a percentage of highly satisfied customers. This helps you understand your likely retention rates.

Pros and cons of CSAT

Measuring customer satisfaction with a CSAT or similar is critical to the success of any product. However, the CSAT rating (like the NPS and CES) lacks depth and actionable insights, offering only a simplified look into customer sentiment.

Even if you have a follow-up question that asks for more details, it takes time and effort to distill their comments into an action plan for your team.

Being a truly customer-focused business requires in-depth research and a connection with customers that begins before these scores come into play.

Let’s take a look at other methods for measuring and improving customer satisfaction that can complement your NPS, CES, or CSAT ratings.

Product engagement data

Your product adoption rate, growth rate, and how “sticky” your product is are all metrics that combine for a product engagement score, or PES. The PES is useful because it tells you whether customers are getting value from your product or a new feature.

First, you take the number of people who used your product or feature and divide it by the total number of people who were exposed to it: that’s your adoption rate.

Then you look at how many customers used the product or feature again: that’s your “stickiness” rate, because it shows how many customers come back.

Lastly, you measure over time to see growth (or contractions) in the usage rate. Combine those metrics altogether and divide by three to get an average rating – that gives you the overall PES score.

At a high level, the PES shows how many of your customers are engaging with your products and features, and how often, over time. It uses data to gauge customer sentiment without the need for surveys.

But this metric still fails to provide the qualitative feedback needed to understand why customers like or dislike your product, and how you can improve it. That’s where PickFu comes in.

Proactive customer research with PickFu polls

As we’ve touched on, the biggest challenge with most customer feedback scores is the lack of context and qualitative data behind them.

PickFu (a do-it-yourself consumer research platform) makes it easy to uncover reliable, high-quality insights from your customers to guide your decision-making process. People use PickFu to run polls asking their target audience for feedback on their products, services, designs, ideas, and more.

The other advantage of PickFu is that you can use it at all stages of your product development and roll-out. For example, if you’re developing a new app, you can perform app market research, use PickFu to test ideas and designs during development, and then verify the customer experience once your product is in the market.

You can also drill down into your target demographic and send your polls only to the people who matter most to your business. PickFu has a built-in panel of 15 million respondents across 90+ demographic segments, so you can get the most relevant insights.

There are many types of market research surveys you can use. Here’s an overview of some of the flexible poll types PickFu offers for different use cases.

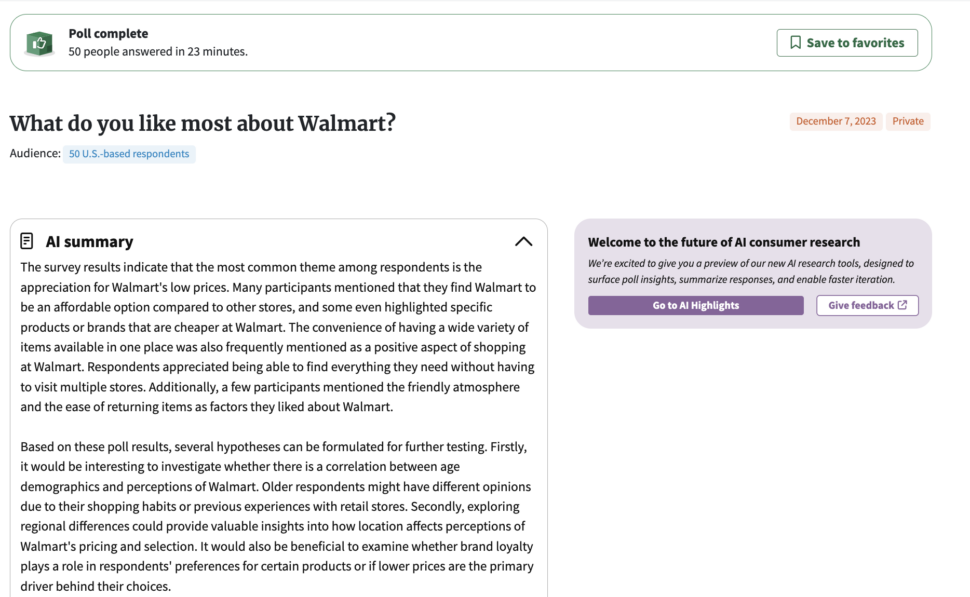

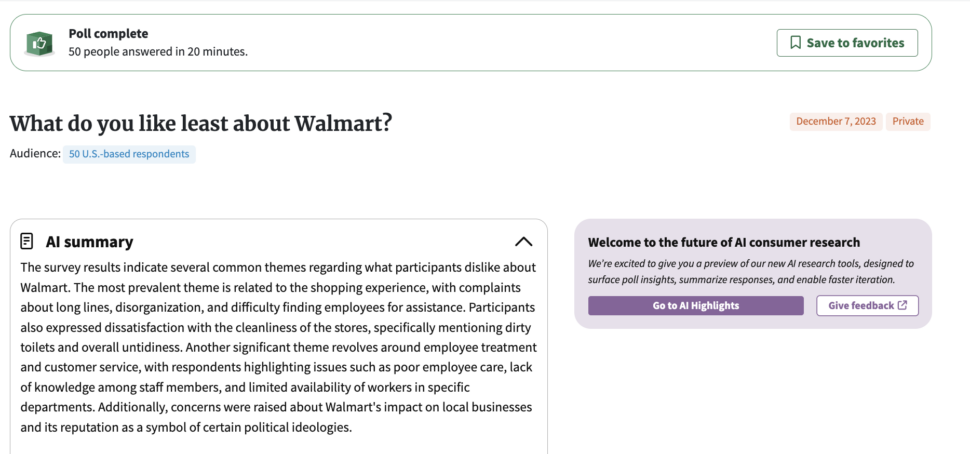

Open-Ended polls

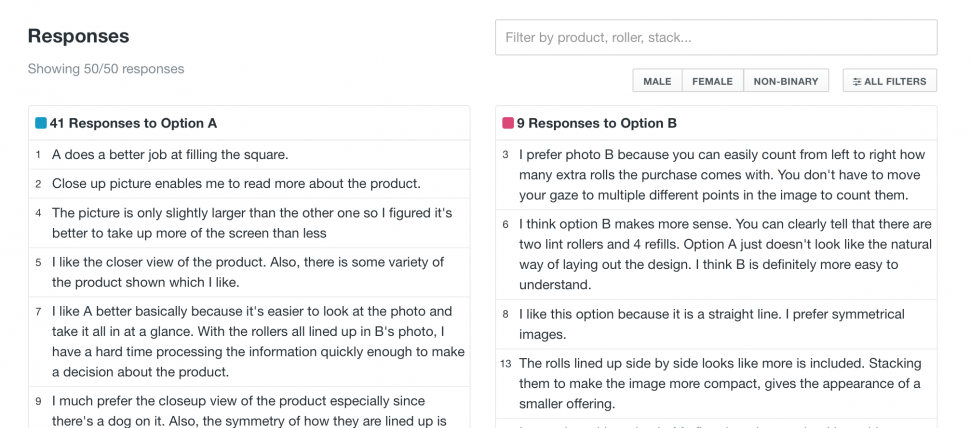

Open-Ended polls invite respondents to give you unfiltered and unguided feedback. For example, you could ask, “What do you like most about product X, or business X?” You could also ask what they like least about the products.

or;

The responses your audience gives are then analyzed with artificial intelligence (AI) tools. The AI Summary will identify key themes and messages, distilling dozens of free-form answers into clear, actionable insights.

You can even use Open-Ended polls to ask about your competitors or your market segment in general. Let’s say you have a software program that helps people organize tasks. You could ask your customers, “What’s the best feature you’ve seen on any project management tool?” and get a whole new idea for features to add to your own product.

Ranked polls

Ranked polls let you compare three to eight different options against each other. As a customer survey, they can help you benchmark your performance in different areas. For example, you might ask “Which of these product features do you find the most helpful?” and present a range of your own features.

The audience will then rank the features in the order they find most helpful, and explain why they chose the order they did.

Head-to-Head polls

Head-to-Head polls are great at comparing two different features, designs, marketing assets, etc. against each other to gauge how customers respond to them. Like the other methods we’ve covered, you can use these polls at every point of the development cycle or customer journey. It’s also helpful for breaking a tie internally and finding which option appeals to customers more.

As always, you’ll get an AI-generated summary that helps distill the specific needs of your customers into a few short paragraphs, giving you an actionable plan to follow.

Get a higher NPS with full-cycle customer research

Proactive customer research can help you hit the ground running and sets you up to satisfy customers organically from the outset, which has a positive impact on your NPS, CES, and CSAT scores.

It’s a feedback loop that helps you win: using consumer insights tools like PickFu give you quantitative AND qualitative feedback from your audience, which gives you clear improvements to make to your business and products, which therefore helps increase your customer satisfaction scores.

Using a variety of these methods to measure and improve your customer satisfaction will help you lower churn rates, increase customer loyalty, and grow your business.

Start improving your NPS and customer satisfaction today with PickFu.

Frequently asked questions

Is there something better than NPS?

While an NPS offers businesses a quick and easy snapshot into their customer sentiment, it fails to offer actionable insight and context to that snapshot. Pairing an NPS with a more robust consumer insight platform like PickFu will help you understand customer satisfaction levels more comprehensively.

What is a good NPS?

A “good” NPS score differs by industry, but in most cases any rating above zero is considered positive as it means you have more promoters than detractors. The better way to use this rating is as a guideline – if it’s improving, you’re on the right track. If your NPS is falling, then you need to consider changes to your business, product, or feature.

What is the difference between CSAT and NPS?

While CSAT scores offer a rating of overall customer satisfaction, NPS tells you how many of your customers are working to promote your business through word of mouth, referrals and other types of peer-to-peer marketing. It also tells you how many of your customers are working against you, and hurting your ability to grow.