As marketers and product developers, we spend hours planning, building, and executing products and campaigns. Knowing whether that new product direction, app marketing strategy, or sales pitch will work is another challenge entirely.

It’s important to get a temperature check from your target audience to know your strategy is on the right path. But too often, traditional market research and methods of collecting customer feedback are time-consuming and expensive.

So how can you conduct market research and get insights quickly, easily, and reliably? Here are six strategies.

Strategy 1: Assess the market

A key part of go-to-market (GTM) planning is understanding where your product sits in the marketplace. This includes the problem your product is trying to solve, who it’s solving it for, similar products that compete with yours, and their positioning or marketing strategies.

By evaluating the playing field, you can find your unique selling proposition (USP) – what sets your product apart from the rest. Your USP will help you build more efficient, effective, and targeted marketing efforts and campaigns.

SEMRush, a keyword research platform, has a tool called Market Analysis, which is a powerful way to begin your competitive analysis. Market Analysis gives you a high-level outlook on your competitors by assessing their websites and market share. It will show you the overall market size and the growth rate of startups and established companies in your field.

You can also use SEMRush’s Market Explorer tool to see the biggest drivers of traffic to competitor websites from a range of sources, including:

- Organic and paid search

- Organic and paid social media

- Paid ad campaigns

- Direct traffic

These tools offer a snapshot of key industry metrics and point to the best performers in your segment. You can also use SEMRush’s search term tools to discover which words your potential clients are using to find products like yours.

These insights can help you tailor your marketing efforts to capture your target audience and help you understand what those customers value most. Let’s say you produce software that tracks expenses. If SEMRush shows that one of the common search terms for this segment is “photo upload tool for expenses” then you’ll know how important that function is to the people researching vendors.

Strategy 2: Get direct customer feedback

The best way to find out what anyone is thinking is to simply ask them. That’s why getting direct feedback from your target audience is so essential in marketing.

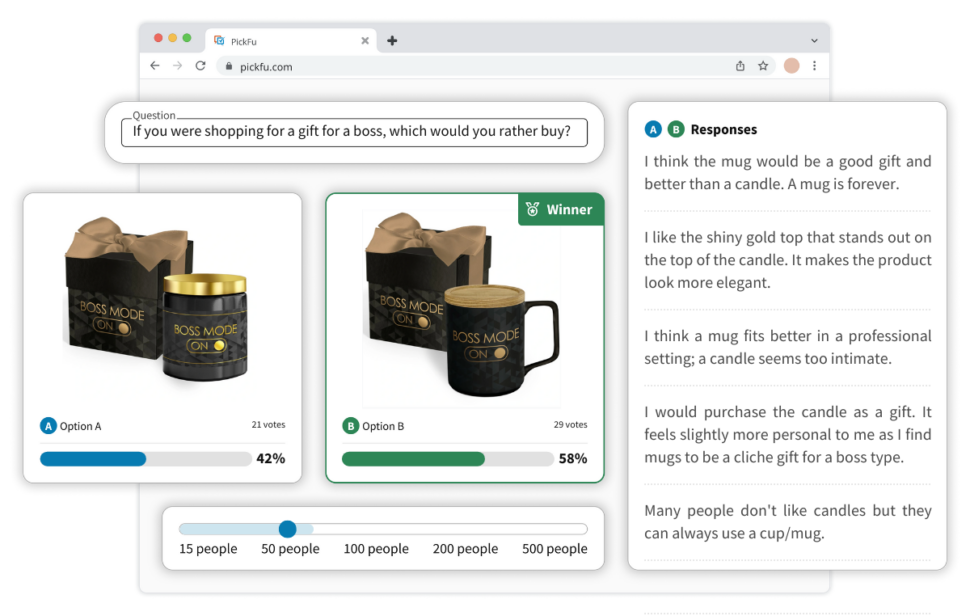

The most important voices to listen to are your current customers and your ideal customers. Finding a place to post a survey or poll can be tedious and costly. However, online survey and polling tools like PickFu make it easy to quickly access a large subset of your potential customers and get their opinions, often within minutes or hours.

These questionnaires are faster, more cost-effective, and less intrusive than a focus group and also easier to read. You can segment the audience to make sure you get quality answers from your target customers, with market segmentation options by industry, demographic, interests, and more. This is useful whether you’re an entrepreneur or work for a large e-commerce brand.

Here’s an overview of the different poll types available with PickFu. Each one of them can help you collect feedback on marketing campaigns, product ideas, designs, and more to inform your business decisions.

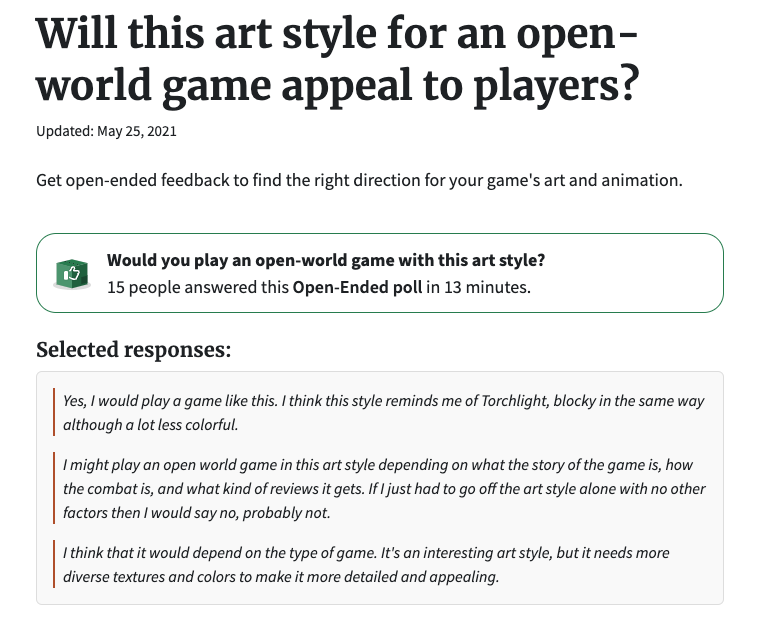

Open-Ended polls

Open-Ended polls allow you to gather written, qualitative feedback on early-stage concepts and designs. You can upload images or videos to gather feedback on, or simply ask a question. The respondents’ answers are open-ended and give you a glimpse into their preferences and how they think.

This type of poll is useful for the first stages of product development and market validation. Let’s say you ask the question, “What takes you the most time when you’re creating invoices?” The responses might include things like “looking up vendor names” or “remembering product codes.” This can help you determine what features you’ll take to market first when you launch your new accounting software.

Open-Ended polls also benefit from PickFu’s natural language processing AI tools that group similar words and answers together, giving you a quick overview of customer sentiment.

[Check out this Open-Ended poll example to see how it can help you understand your customers’ needs and wants.]

Ranked polls

Ranked polls help you narrow down options when you have too many to pick from. It might help you determine how to spend your marketing budget, for example, if you poll respondents on which media they consume the most. Or if you have several design ideas for a product, you can ask the audience which one they prefer most. From there, you’ll be able to make data-driven decisions about the next steps for your product or campaign.

[Check out this Ranked poll example to see how it can help you understand your customers’ needs and wants.]

Head-To-Head polls

Head-to-Head polls allow you to test two options against each other. For example, if you have two taglines for your product and can’t decide between them, you could ask respondents which they like most. This head-to-head style is great for the later stages of your development process.

You can ask questions and receive written feedback in all of these poll types, giving you a mix of qualitative and quantitative answers from the survey panel.

Because PickFu lets you access a pool of 15 million respondents across 90 different demographic subsets and multiple countries, you’ll end up with a high-quality, targeted set of results for your project – in a fraction of the time as traditional market research.

Sign up today to conduct quick and easy market research with PickFu.

Strategy 3: Check in with your competitors’ customers

In the first strategy, we looked at the overall competitive landscape in your specific industry or field. In this strategy, we’ll go deeper to see how people are responding to your competition. This is especially effective if you’re a new player in an established industry, or if you’ve found a way to augment an existing market.

Knowing what your competitors’ customers are saying can help you stay on top of market trends, identify gaps or opportunities, and accelerate your marketing efforts.

There are lots of tools for listening to consumer sentiment for your own brand, and some of these can be expanded to listen to third parties. Awario is a brand mention listening tool that allows you to check for mentions of specific brands, whether it’s yours or others. You can filter for mentions across the web in general, as well as a range of social media sources, including:

- X (Formerly Twitter)

- YouTube

You can also filter results by language, location, and time period to narrow down your search. It will assess both positive and negative feedback about the brand.

Sprout is a pioneer in social media listening, and like Awario, you can use it to find out what consumer sentiment is for your brand, your competitors, or your industry in general. It also uses natural language processing tools to gauge customer sentiment and build reports that you can use to guide your decisions. For example, if you discover that negative feedback about your competitor often focuses on their website’s downtime or slowness, you’ll know to prioritize your own website speed.

Strategy 4: Leverage focus groups

Focus groups are a good way to compile guided feedback from a curated panel of your target demographic. You can use focus groups to get feedback, assess designs, test software, and more. Focus groups can help accelerate your marketing by giving you a deeper understanding of how the public will engage with your product or solution.

Compiling a focus group panel is a tricky part of this process, but you can use tools like the iiM 12Q in-person panel solution to pull together target groups quickly.

Best practices for selecting a focus group include:

Understanding your target market. Before you decide to engage a focus group, you should have some understanding of who your product is for. For example, if your solution is in human resources, you’ll want to target HR and people managers.

Gathering a diverse group of participants. The broader the population you have represented in your focus room, the more they’ll reflect the consumer you want to engage with. Obviously, you’ll want to narrow the panel down to your target demographic, but within that, try to represent diverse experiences and backgrounds.

Giving your panel room to engage with your product or solution organically. It’s easy to want to give your panel too much guidance or lead their answers with your questions. The most surprising in-person market research results often come from just letting your panel interact with your product organically, without specific prompting.

In-person focus groups can be expensive and difficult to arrange, but you may uncover unexpected, valuable insights that inform your marketing decisions.

Strategy 5: Be active in your target communities

It’s easier to accelerate your GTM campaigns if you already have a little traction in the key communities you’re targeting.

Let’s say you have a product that will make shipping more efficient. If you already participate in LinkedIn discussions or forums where transportation decision-makers are operating, they’ll be more likely to respond to the messages or ads they see from you later. This brand awareness tactic is especially helpful for small businesses or industries with a small customer base.

There are a lot of market research benefits to being in these communities too. You’ll be able to see more of the feedback and pain points that people are discussing organically, and you’ll get a sense of how your target customer is trying to solve those issues on their own.

If you ask an insightful question or help someone in the industry you work with, that outreach will position you or your brand as a thought leader before your first ad ever launches. This is also a good jumping-off point for your brand’s content marketing efforts, as it gives you an idea of the main topics that are already of interest to your future customers.

Because you’re engaged in their conversations, you’ll already “speak the language” of your customers – which will make your marketing more authentic, authoritative, and effective.

Strategy 6: Launch, assess, and adapt

No GTM campaign is 100% successful in its first iteration – and even if it’s working, there’s always room for improvement. The last strategy that will accelerate and boost your results is to continuously assess and adapt your efforts after launch.

There are a number of ways to capture and analyze your campaign or product launch results. Some insights are easy to get and give you a quick temperature check on your success. For example, you might use raw Google Analytics data to measure web traffic and compare that to sales numbers for a high-level view of your conversion rate.

For deeper insights, you’ll want to look at how your audience actually feels about your product and campaigns. PickFu Click Tests and Open-Ended polls can help you optimize your website pages or marketplace listings, get feedback on your products, and fine-tune the customer journey post-launch. This is a relatively quick, simple way to continue your market research post-launch and improve your offerings.

Faster, easier market research can amplify your GTM campaigns

It only takes a small amount of market research and planning to elevate your GTM campaigns and marketing efforts to new levels. Many market research tools, including PickFu, are easy for anyone to use, with rapid, actionable in-depth feedback from qualified respondents.A g

Sign up for PickFu today and begin receiving insights in as little as a few hours.